Now Reading: Understanding the National Finance Commission

-

01

Understanding the National Finance Commission

Understanding the National Finance Commission

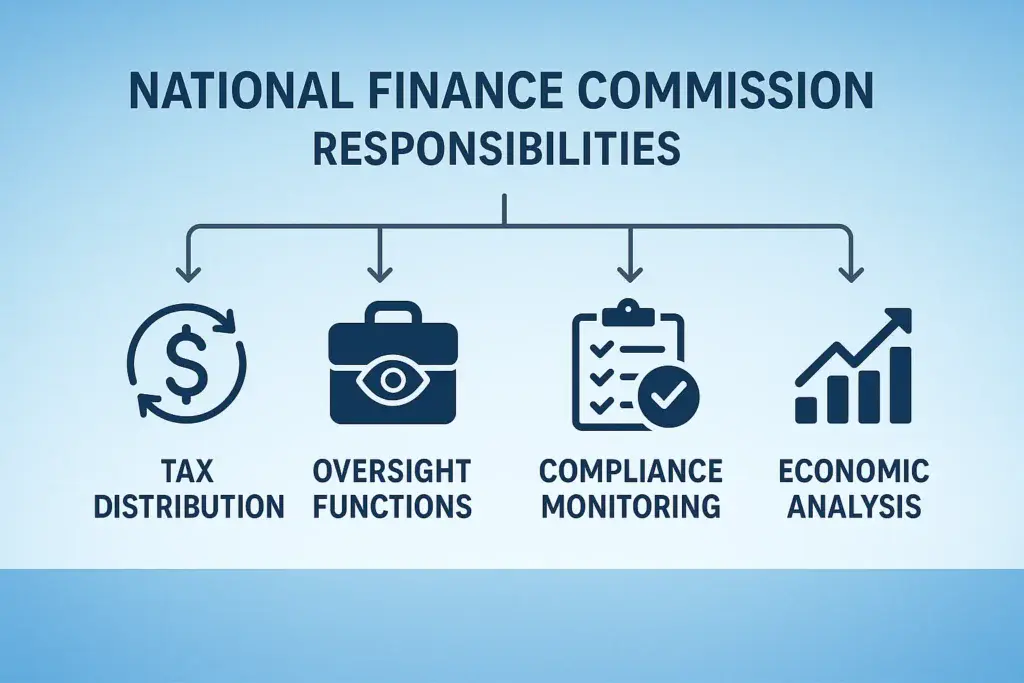

Have you ever wondered how a country with multiple states or provinces manages its money? How does the national government decide how much money to give to each regional government for things like schools, roads, and healthcare? This complex task often falls to a special body known as a national finance commission. This organization plays a a vital role in balancing the financial needs of different government levels, ensuring that public funds are distributed fairly and effectively across the nation. Understanding the purpose and function of a national finance commission is key to grasping how modern federal systems operate and maintain financial stability for all their citizens.

Key Takeaways

- Central Role: A national finance commission is a specialized body, usually temporary, that recommends how a country’s financial resources should be shared between the national government and its state or provincial governments.

- Promotes Equity: Its primary goal is to promote fairness and balance in public finances, ensuring that regions with fewer resources still receive the funds needed to provide essential public services.

- Data-Driven Process: The commission bases its recommendations on extensive research, analyzing data on population, income levels, development needs, and each government’s ability to raise its own revenue.

- Advisory Function: While its recommendations are highly influential and often accepted, a national finance commission typically acts in an advisory capacity. The final decision usually rests with the national legislature or executive branch.

- Impact on Citizens: The work of a national finance commission directly affects citizens by influencing the quality and availability of public services like education, healthcare, and infrastructure in their local communities.

What is a National Finance Commission?

At its core, a national finance commission is an expert committee established by a country’s government to address the complex issue of fiscal federalism. Think of it as a referee in the financial relationship between a central government and its various states or provinces. Its main job is to make recommendations on how to divide the nation’s collected tax revenue. This isn’t just about splitting a pot of money; it’s a carefully calculated process designed to ensure vertical and horizontal equity.

Vertical equity refers to the fair division of resources between the central government and the collective state governments. Horizontal equity aims to ensure a fair distribution of funds among the different states, recognizing that some regions may be more populous, less developed, or have a smaller tax base than others. The commission helps bridge these gaps so that every citizen, regardless of which state they live in, has access to a comparable level of public services.

Why Do Countries Establish a National Finance Commission?

Countries with a federal structure, where power is shared between a national government and regional governments, face a unique challenge: fiscal imbalance. The central government often collects the majority of major taxes (like income and corporate taxes), while states are responsible for delivering many of the most expensive public services (like education and public health). This mismatch creates a need for a formal, unbiased system to transfer funds from the center to the states. This is where a national finance commission becomes essential.

By creating this body, a country can:

- Depoliticize a Sensitive Issue: Deciding who gets how much money can be highly political. An independent commission, made up of experts in finance, economics, and public administration, can make recommendations based on objective criteria rather than political favoritism.

- Ensure Predictability: The commission’s periodic reviews provide states with a predictable and transparent framework for financial planning. They know that every few years, their needs will be reassessed based on a consistent set of principles.

- Adapt to Changing Needs: Economies and demographics are not static. A state might experience a sudden population boom, a natural disaster, or an economic downturn. A national finance commission can regularly reassess these changing circumstances and adjust its recommendations accordingly, ensuring the system remains responsive and relevant.

How Does the Commission Actually Work?

The process undertaken by a national finance commission is methodical and data-intensive. It begins with a clear mandate, often outlined in the country’s constitution or a specific law. This mandate, or Terms of Reference, defines what the commission must investigate. The membership is typically small, comprising a chairperson and a few other members who are experts in fields like economics, public finance, and law. Once formed, the commission embarks on an extensive data collection and consultation phase.

It gathers vast amounts of information from central government ministries, state governments, local bodies, and independent experts. This includes data on population, poverty levels, infrastructure gaps, tax collection efforts, and the cost of delivering services. The commission travels across the country, holding meetings with state leaders to understand their unique challenges and financial requirements firsthand. This consultative approach is crucial for building trust and ensuring that its final report reflects the realities on the ground.

The Role of Data and Criteria

The recommendations are not arbitrary. The commission uses a specific formula to determine the share of each state. This formula weighs various criteria, which might include:

- Population: A state’s share of the national population.

- Area: Larger states may have higher costs for infrastructure and administration.

- Income Distance: A measure of how far a state’s per capita income is from that of the wealthiest state, aiming to help poorer states catch up.

- Forest Cover: Rewarding states for maintaining environmental resources that benefit the entire country.

- Fiscal Discipline: Incentivizing states that manage their finances prudently.

The Role of a National Finance Commission in Federal Systems

In a federal system, a national finance commission acts as a critical institutional mechanism for managing intergovernmental fiscal relations. It is the primary vehicle for what are known as intergovernmental transfers, which are funds moved from the central government to state and local governments. These transfers are vital for correcting fiscal imbalances and ensuring that all regions can function effectively. Without such a system, wealthier states would grow richer while poorer states would struggle to provide even basic services, leading to greater regional inequality and potential political instability.

The commission’s work strengthens the fabric of the federation by creating a more cooperative and balanced financial partnership between different levels of government. It helps transform the relationship from a competitive one, where states vie for funds, to a more collaborative one built on established principles and mutual understanding.

Implementing the Commission’s Recommendations

Once a national finance commission completes its detailed analysis and consultations, it submits a comprehensive report to the government. This report contains its final recommendations on the distribution of financial resources. It is important to note that the commission’s role is typically advisory. Its recommendations are not automatically legally binding. However, they carry immense weight due to the commission’s expertise, independence, and the transparent process it follows.

In most countries, the report is presented to the national legislature (like a Parliament or Congress), which then discusses and debates the findings. Usually, the executive branch of the government accepts the core recommendations, which are then implemented through legislation, such as the annual budget. This acceptance is a crucial step that translates the commission’s expert advice into tangible financial flows that directly impact states and their citizens. The high rate of acceptance in many countries underscores the credibility and importance of the commission’s work.

Ensuring Transparency and Accountability

For a national finance commission to be effective, its processes must be transparent and its members accountable. Transparency is built into its operations from the start. The commission’s mandate is made public, and its final report is usually published and made accessible to everyone. This allows state governments, academics, journalists, and the public to scrutinize its methodology and conclusions. Accountability is ensured through its structure; as a body created by constitutional or legal provision, it is answerable to the government and, by extension, to the people.

Furthermore, the practice of holding wide-ranging consultations with various stakeholders is a form of accountability in itself, ensuring that diverse perspectives are heard and considered. As explored on platforms like Forbes Planet (https://forbesplanet.co.uk/), transparency in public finance is a cornerstone of good governance, and the national finance commission model is a prime example of this principle in action.

Impact on State and Local Governments

The recommendations of a national finance commission have a profound and direct impact on the financial health of state and local governments. A favorable recommendation can provide a state with the necessary resources to launch new development projects, improve schools, hire more doctors, and upgrade infrastructure. Conversely, a smaller-than-expected share can force a state to make difficult choices, such as cutting spending or raising local taxes. This is why states invest significant effort in presenting their cases to the commission. For local governments (like cities and counties), the commission’s work is also vital. Often, the commission recommends specific grants for local bodies to help them deliver essential civic services like sanitation, drinking water, and local road maintenance, thereby strengthening governance from the ground up.

The Role in Economic Stabilization

Beyond just dividing revenue, a national finance commission often plays a subtle but important role in broader economic stabilization. By providing a predictable flow of funds to states, it helps them manage their budgets more effectively, which contributes to overall macroeconomic stability. The commission can also design its recommendations to support national policy goals. For example, it might introduce performance-based incentives or grants tied to specific reforms in sectors like power, education, or business regulation. If a country is facing an economic downturn, the commission might recommend providing more flexible funds to states to help them cushion the impact on their populations. In this way, the commission’s work is not just about accounting; it is an integral part of a nation’s economic policy toolkit, helping to steer the country toward sustainable and equitable growth.

Common Challenges and Misconceptions

Despite their importance, these commissions face several challenges. States may provide inaccurate data to try and secure more funds, or there may be political pressure to favor certain regions. A common misconception is that the commission simply gives money away. In reality, its recommendations are based on a complex balancing act between assessing needs, rewarding performance, and ensuring fiscal prudence. Another challenge is keeping its formula relevant in a rapidly changing world. The criteria used a decade ago may not be suitable today, requiring each new commission to innovate while maintaining consistency.

|

Feature |

National Finance Commission Model |

Ad-Hoc Grant System |

|---|---|---|

|

Basis of Decision |

Formula-based, using objective criteria (population, income, etc.) |

Discretionary, often based on specific requests |

|

Predictability |

High; states know the framework and cycle for review. |

Low; funding can be unpredictable and inconsistent. |

|

Transparency |

High; process and reports are generally public. |

Low; decisions may be made without public scrutiny. |

|

Goal |

To ensure long-term equity and balance in the federal system. |

To address immediate, specific needs or projects. |

|

Structure |

Independent, expert body with a constitutional or legal mandate. |

Typically handled by executive ministries or departments. |

Comparing to US Federal-State Fiscal Relations

For readers in the United States, the concept of a constitutionally mandated national finance commission might seem unfamiliar. The US does not have a single, recurring body with this exact name or comprehensive mandate. However, the principles behind it are very much alive in the American system of fiscal federalism. The US federal government distributes trillions of dollars to states and local governments through a complex web of over 1,300 federal grant programs. These are managed by various federal agencies, like the Department of Health and Human Services (for Medicaid) and the Department of Transportation (for highway funds).

Instead of one commission, the US uses:

- Formula Grants: Funds distributed to states based on formulas set by Congress. These formulas often use factors similar to those a finance commission would use, such as population, per capita income, and specific needs.

- Congressional Budget Office (CBO): A non-partisan agency that provides economic data and analysis to Congress, playing a role similar to the research arm of a finance commission.

- Advisory Committees and Task Forces: Occasionally, special commissions are formed to study specific fiscal issues, though they lack the recurring, constitutional authority of a national finance commission.

While the mechanisms differ, the underlying goal is the same: to use federal resources to support state-level services, address economic disparities, and achieve national policy objectives.

Conclusion

The national finance commission is a cornerstone of fiscal management in many federal countries. It serves as an independent and expert arbiter, ensuring that a nation’s wealth is shared equitably to support public services for all citizens. By operating on principles of transparency, data-driven analysis, and consultation, it transforms the potentially contentious process of dividing money into a structured and fair exercise. It balances the needs of different regions, promotes economic stability, and strengthens the very foundation of a federal partnership. While the specific model may not exist everywhere, its core function of managing intergovernmental financial flows is a universal feature of modern, multi-tiered governance.

Frequently Asked Questions (FAQ)

1. What is the main purpose of a national finance commission?

A national finance commission is primarily tasked with recommending how a nation’s tax revenues should be divided between the central government and its state or provincial governments to ensure fairness and support public services.

2. Are the recommendations of the commission binding?

Typically, no. The commission acts as an advisory body. However, its recommendations are based on extensive research and expert analysis, so they carry significant weight and are usually accepted by the government with few, if any, modifications.

3. How often is a national finance commission formed?

This varies by country, but they are generally constituted at regular intervals, often every five years. This periodic review allows the system to adapt to changing economic and demographic conditions across the country.