Now Reading: Stock Market Closed Jimmy Carter: Unpacking a Financial Myth

-

01

Stock Market Closed Jimmy Carter: Unpacking a Financial Myth

Stock Market Closed Jimmy Carter: Unpacking a Financial Myth

Have you ever heard a rumor that the stock market closed because of a president? It’s a compelling story, but often, the truth is more nuanced. A common question that surfaces is about the “stock market closed Jimmy Carter” era. This phrase suggests a time of such economic turmoil during President Jimmy Carter’s term that Wall Street had to shut down. But did this actually happen?

We’re going to dive into the economic conditions of the late 1970s, explore what was really happening with the stock market, and separate the facts from the fiction. Understanding this period gives us valuable insight into how politics, global events, and the economy are all connected. Let’s unravel the story behind the stock market during Jimmy Carter’s presidency.

Key Takeaways

- There is no historical record of the New York Stock Exchange (NYSE) or any major U.S. stock market closing for an extended period due to economic policy or crisis during Jimmy Carter’s presidency (1977-1981).

- The Carter years were marked by significant economic challenges, including high inflation, high unemployment (stagflation), and two energy crises.

- The stock market experienced high volatility and poor overall performance during this time, but it remained open for trading.

- The idea of the stock market closed Jimmy Carter is a persistent myth, likely stemming from the genuine economic anxiety and poor market sentiment of the era.

- Understanding this myth helps illustrate how public perception and economic reality can sometimes diverge.

The Economic Climate of the Carter Presidency

To understand the origins of the stock market closed Jimmy Carter myth, we must first look at the economic landscape of the late 1970s. When Jimmy Carter took office in 1977, he inherited an economy already struggling with serious issues. The primary challenge was a phenomenon known as “stagflation”—a toxic mix of stagnant economic growth, high unemployment, and soaring inflation. This was a new and difficult problem for economists and policymakers, who were accustomed to inflation and unemployment moving in opposite directions.

Several factors contributed to this difficult environment. The lingering effects of the Vietnam War and increased government spending had put pressure on the U.S. dollar. More critically, the nation was reeling from the 1973 oil embargo, which had quadrupled oil prices and sent shockwaves through the global economy. This dependence on foreign oil would once again become a central issue during Carter’s term. These deep-seated problems created a sense of instability and uncertainty that deeply affected American households and, by extension, the stock market.

What is Stagflation?

Stagflation is an economic condition defined by three core problems happening at the same time:

- Stagnant Growth: The economy is not growing, or is growing very slowly.

- High Inflation: The cost of goods and services rises rapidly, reducing the purchasing power of money.

- High Unemployment: A large number of people are out of work.

This combination puzzled economists because traditional economic theories suggested that inflation and unemployment had an inverse relationship. The stagflation of the 1970s challenged these ideas and made it incredibly difficult for the government and the Federal Reserve to find a solution. Fighting inflation with higher interest rates could worsen unemployment, while stimulating the economy to create jobs could fuel even more inflation.

The Energy Crisis: A Major Blow to the Economy

A defining feature of the Carter years was the second major energy crisis of the decade. In 1979, the Iranian Revolution led to a significant disruption in global oil supplies. Iran, a major oil producer, saw its output plummet. This caused panic in the markets, and oil prices skyrocketed once again. For Americans, this meant long lines at gas stations, fuel rationing, and a sharp increase in the cost of everything from heating homes to transporting goods.

This energy crisis had a direct and damaging impact on the U.S. economy. It fueled inflation, as businesses passed their higher energy costs on to consumers. It also slowed economic growth, as both consumers and businesses cut back on spending in the face of uncertainty and higher expenses. The crisis amplified the feeling that the economy was spiraling out of control, which contributed to the negative sentiment surrounding the Carter administration and the market. This backdrop of crisis is fertile ground for myths like the stock market closed Jimmy Carter to take root.

Stock Market Performance from 1977-1981

So, with all this economic turmoil, what was the stock market actually doing? The performance of the Dow Jones Industrial Average (DJIA), a key indicator of market health, was lackluster and highly volatile throughout the Carter presidency. The market was essentially “treading water” for years, failing to produce any significant returns for investors when adjusted for the high rates of inflation.

For instance, the DJIA started Carter’s term in 1977 around the 950-point mark. By the end of his presidency in early 1981, it was hovering around the same level. While it had peaks and valleys in between, the overall trend was flat. When you factor in double-digit inflation, investors were actually losing purchasing power by keeping their money in the stock market. This poor performance, combined with the daily news of economic woes, understandably made many people feel pessimistic about their investments and the country’s financial future.

Debunking the Myth: Did the Stock Market Close?

Here we address the core question: Is the claim about the stock market closed Jimmy Carter true? The answer is a clear and definitive no.

The New York Stock Exchange (NYSE) and other American exchanges have closed for various reasons throughout history—natural disasters like Hurricane Sandy, national days of mourning for presidents, and technical glitches. The longest closure was for four months at the start of World War I in 1914. However, there is absolutely no historical evidence that the stock market shut down due to the economic policies or crises of the Carter administration.

The market remained open and functional every trading day. While it was a difficult and volatile period for investors, the fundamental operations of Wall Street continued without interruption. The myth likely persists because it serves as a powerful, albeit inaccurate, metaphor for the severe economic distress of the era.

Why Do People Believe the Market Closed?

The persistence of the stock market closed Jimmy Carter rumor speaks to the power of collective memory and emotion. For those who lived through it, the late 1970s were a time of genuine hardship. The feeling of economic crisis was real. Therefore, the idea of something as drastic as the market closing “feels” true to the experience, even if it isn’t factually correct. It’s a simplified story that encapsulates a complex and painful period of economic history. Misinformation can spread easily, and over time, a powerful narrative can become accepted as fact, especially when it aligns with a strong political or economic viewpoint.

Carter’s Economic Policies and the Federal Reserve

President Carter did not stand by idly. His administration implemented several policies aimed at tackling stagflation. He focused on deregulation, particularly in the trucking and airline industries, to increase competition and lower prices. He also tried to encourage energy conservation and investment in alternative energy sources to reduce America’s dependence on foreign oil.

However, his most consequential economic decision was appointing Paul Volcker as Chairman of the Federal Reserve in 1979. Carter gave Volcker the political backing to take on inflation head-on. Volcker implemented a policy of aggressively raising interest rates to levels not seen before. This “shock therapy” was designed to break the cycle of inflation by making it very expensive to borrow money, which would cool down the economy.

The Volcker Shock

Paul Volcker’s strategy was painful in the short term. The high interest rates pushed the country into a deep recession in the early 1980s and caused unemployment to spike even further. However, it was ultimately successful. By the mid-1980s, inflation had been brought under control, setting the stage for the sustained economic growth that followed. While this policy caused immense short-term pain and likely contributed to Carter’s loss in the 1980 election, it is now widely seen as a necessary and courageous move to restore economic stability.

Comparing Market Closures in History

To put the stock market closed Jimmy Carter myth in perspective, it helps to look at actual instances when the NYSE has closed. These events are rare and are prompted by extraordinary circumstances.

|

Date(s) of Closure |

Reason for Closure |

Duration |

|---|---|---|

|

July 31 – Dec 11, 1914 |

Outbreak of World War I |

4.5 months |

|

Nov 25, 1963 |

National day of mourning for President John F. Kennedy |

1 day |

|

July 14, 1977 |

New York City blackout |

1 day |

|

Sep 11 – Sep 16, 2001 |

September 11th terrorist attacks |

4 trading days |

|

Oct 29 – Oct 30, 2012 |

Hurricane Sandy |

2 days |

As the table shows, the one-day closure during Carter’s term in 1977 was due to a city-wide power outage, not an economic crisis. This further solidifies that the narrative of a policy-driven market shutdown is false. As further reading on global economic trends shows, market stability is a complex issue, as detailed in resources like those found on https://forbesplanet.co.uk/.

Conclusion

The idea of the stock market closed Jimmy Carter is a compelling piece of financial folklore, but it remains just that—a myth. While the Carter presidency was a period of significant economic challenge marked by stagflation and an energy crisis, the U.S. stock markets remained open and operational. The market’s poor performance and the general feeling of economic malaise created a powerful narrative of failure, from which this rumor was likely born.

By separating fact from fiction, we gain a clearer understanding of this pivotal time in American history. It serves as a reminder that economic performance and public perception are deeply intertwined, and that the stories we tell about the past can sometimes be more powerful than the facts themselves. The Carter years were indeed tough for the economy and for investors, but the lights on Wall Street never went out.

Frequently Asked Questions (FAQ)

Q1: So, to be clear, the stock market never closed because of Jimmy Carter?

Correct. There is no historical record of the NYSE or any other major U.S. stock market closing due to economic policy or crisis during the Carter administration. The market remained open throughout his term from 1977 to 1981.

Q2: Why was the economy so bad under Carter?

President Carter inherited an economy already struggling with stagflation (high inflation and high unemployment). These problems were made much worse by the 1979 energy crisis, which was triggered by the Iranian Revolution and caused oil prices to spike, further fueling inflation and slowing economic growth.

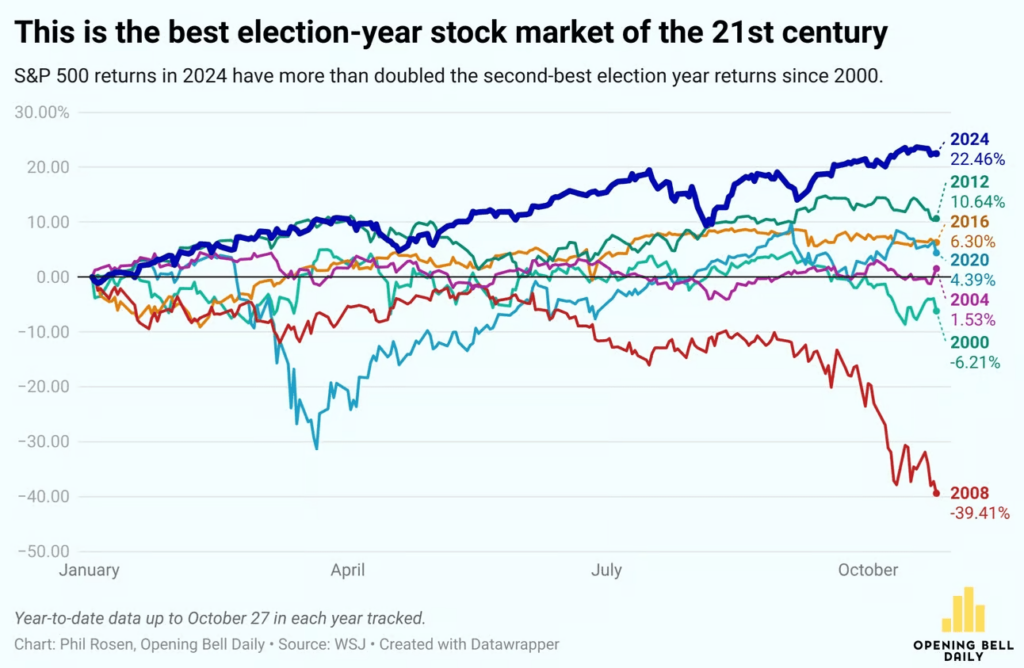

Q3: How did the stock market perform during the Carter years?

The stock market was very volatile and delivered poor returns. The Dow Jones Industrial Average was essentially flat for the four-year period. When accounting for the high inflation of the time, investors actually lost a significant amount of purchasing power.

Q4: What was President Carter’s most important economic policy?

Many economists point to his appointment of Paul Volcker to lead the Federal Reserve as his most significant and impactful economic decision. Carter supported Volcker’s tough stance on fighting inflation by raising interest rates, a policy that, while painful in the short term, ultimately laid the groundwork for future economic stability.

Q5: If the market didn’t close, why do people say “stock market closed Jimmy Carter”?

The phrase is a myth that likely originated from the real economic anxiety of the period. It functions as a powerful, though inaccurate, metaphor for the severe economic distress, poor market performance, and negative sentiment that defined the late 1970s for many Americans.