Now Reading: Cherry Financing: A Simple Guide to Flexible Payments

-

01

Cherry Financing: A Simple Guide to Flexible Payments

Cherry Financing: A Simple Guide to Flexible Payments

Have you ever considered a purchase for your health, wellness, or home but paused because of the upfront cost? Many people look for flexible payment solutions to make these important investments more manageable. This is where options like cherry financing come into play. It’s a modern way to pay for services and products over time, rather than all at once. This guide will walk you through everything you need to know about how cherry financing works, its benefits, how to apply, and what to expect. We’ll explore how this point-of-sale financing can help you get the treatments and items you need without breaking your budget.

Key Takeaways

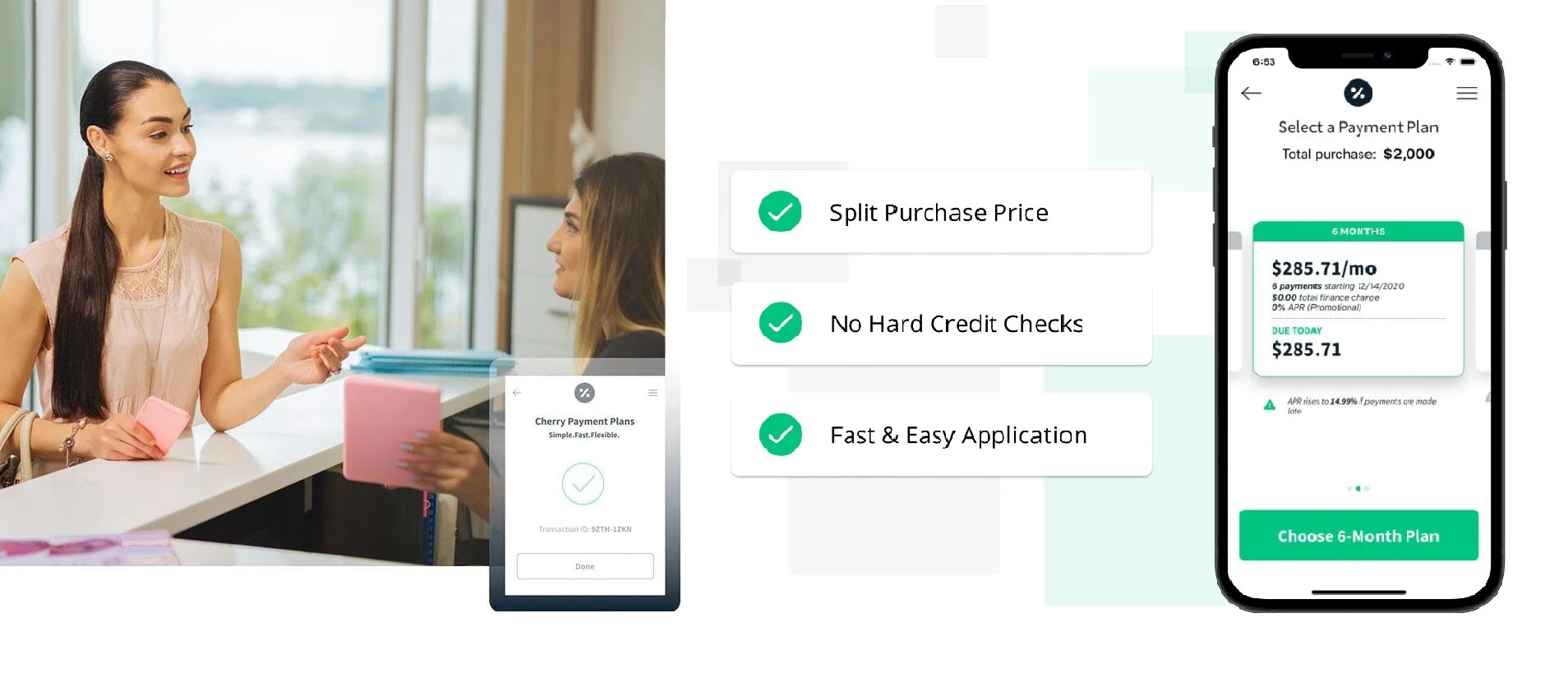

- What is Cherry Financing? It’s a “buy now, pay later” (BNPL) service that lets you split the cost of purchases from participating merchants into smaller, monthly payments.

- How it Works: You apply through a participating business, get a quick decision (often in seconds), and choose a payment plan that fits your budget. The process is designed to be fast and simple.

- Key Benefits: Major advantages include fast approvals, the use of a soft credit check for pre-qualification, and a variety of payment plan options, some with promotional 0% APR.

- Where to Use It: Cherry financing is commonly available at dental offices, medical spas, veterinary clinics, and home improvement businesses.

What Exactly is Cherry Financing?

At its core, cherry financing is a point-of-sale financing company that partners with various businesses to offer customers payment plans. Think of it as a modern alternative to traditional credit cards or personal loans, specifically designed for purchases made at a specific merchant. When you choose to pay for a service or product, instead of paying the full amount upfront, you can apply for a cherry financing plan. If approved, Cherry pays the merchant for you, and you then repay Cherry in fixed monthly installments over a set period.

This model is part of the growing “buy now, pay later” (BNPL) industry. Its goal is to make larger purchases more accessible by breaking them down into predictable, budget-friendly payments. The process is streamlined to happen right at the checkout, whether online or in-person. Unlike a credit card that gives you a revolving line of credit for any purchase, cherry financing is typically used for a single, specific purchase at a partner business. This helps you manage debt for a particular need without impacting your overall credit line. It’s an attractive option for people who need medical procedures, dental work, or even home repairs but prefer not to pay a large lump sum immediately.

How Does the Cherry Financing Application Process Work?

Getting started with cherry financing is designed to be quick and straightforward. The entire process often takes just a few minutes and can be completed right at the merchant’s office or on their website. The first step is to find a participating business that offers it as a payment option. Once you know the cost of the service or product you want, you can begin the application. You’ll need to provide some basic personal information, such as your name, address, and mobile number. A key feature here is that cherry financing uses a soft credit check to pre-qualify you.

This is a significant benefit because a soft credit check does not impact your credit score. It allows the system to review your credit history to determine your approval odds and what payment plans you might qualify for, all without leaving a hard inquiry on your report. After submitting your information, you’ll receive a decision almost instantly. If you are approved, you will be shown several payment plan options. These plans vary in length (e.g., 6, 12, 24 months) and Annual Percentage Rate (APR). You simply select the plan that works best for your financial situation and complete the final steps to activate your financing.

The Major Benefits of Using Cherry Financing

One of the biggest draws of cherry financing is its speed and convenience. The application is fast, with decisions often returned in under a minute. This eliminates the long waiting periods associated with traditional bank loans. Another key advantage is the use of a soft credit check for pre-qualification. Many people are hesitant to apply for credit because they worry about a hard inquiry lowering their credit score. With cherry financing, you can see your options without that initial negative impact, making it a lower-risk way to explore your payment possibilities.

Flexibility is also a core benefit. Cherry financing offers a range of payment plans, allowing you to choose one that aligns with your monthly budget. Some merchants even offer promotional plans with 0% APR for a specific term, meaning you pay no interest if you pay off the balance within that period. This can result in significant savings compared to high-interest credit cards. Finally, the approval process considers more than just a credit score, which means it may be accessible to a wider range of applicants. This inclusive approach helps more people get the necessary services and products they need, when they need them.

Where Can You Use Cherry Financing?

The availability of cherry financing has expanded across several industries, primarily focusing on health, wellness, and essential home services. You won’t find it at your local grocery store, but you are very likely to see it offered at businesses that provide higher-cost services. One of the most common places to use cherry financing is in the healthcare sector. This includes dental offices for procedures like crowns or implants, medical spas for cosmetic treatments, and even veterinary clinics for unexpected pet medical bills.

Beyond healthcare, it is also gaining traction in the home improvement industry. Contractors and businesses offering services like HVAC repair, plumbing, or flooring may partner with Cherry to help homeowners finance necessary projects. The common thread among these merchants is that they offer services that are often a significant, and sometimes unexpected, expense. By providing cherry financing as an option, these businesses make their services more attainable for a broader customer base, enabling people to move forward with important life purchases without delay. As more businesses recognize the value of flexible payments, the network of participating merchants continues to grow.

Understanding Interest Rates and Fees

When considering any financing option, it’s crucial to understand the costs involved. With cherry financing, the primary cost is the Annual Percentage Rate (APR), which is the interest you’ll pay on the amount you finance. Your APR is determined based on several factors, including your credit history. Rates can vary significantly, from as low as 0% for promotional offers up to higher rates for applicants with lower credit scores. A 0% APR plan is an excellent deal, as it means you only pay back the principal amount borrowed, with no extra interest charges, as long as you complete payments within the promotional window.

It’s important to carefully review the terms of your agreement before accepting. The document will clearly state your APR, the total amount you will pay over the life of the loan (including interest), and your monthly payment amount. Some BNPL services may have other fees, such as late fees if you miss a payment, so always read the fine print. Cherry financing aims for transparency, ensuring you know all the costs upfront. By understanding your APR and payment schedule, you can make an informed decision and ensure the plan fits comfortably within your long-term budget.

Cherry Financing vs. Other Payment Options

It’s helpful to see how cherry financing stacks up against other common payment methods. While it shares similarities with credit cards and personal loans, there are key differences that might make it a better fit for certain situations. For example, unlike a credit card that provides a revolving line of credit, a cherry financing plan is an installment loan for a specific purchase. This can help with budgeting, as you have a clear end date and a fixed payment amount. Many financial experts, like those at https://forbesplanet.co.uk/, emphasize the importance of understanding different credit products before using them.

Credit cards offer great flexibility but often come with higher average APRs. Personal loans from a bank might offer lower rates but usually involve a more complex application process and a hard credit inquiry from the start. “Buy now, pay later” services are known for their speed and soft credit checks, making them highly accessible. The best choice depends on your financial health, the purchase amount, and your personal preferences for managing debt.

Comparison of Payment Options

|

Feature |

Cherry Financing |

Credit Card |

Other BNPL Services |

Personal Loan |

|---|---|---|---|---|

|

Best For |

Specific, one-time purchases at partner merchants |

Everyday purchases and building credit |

Small to mid-size retail purchases |

Large, planned expenses (e.g., debt consolidation) |

|

Credit Check |

Soft check to pre-qualify |

Hard check upon application |

Often soft check or no check for smaller amounts |

Hard check upon application |

|

Interest (APR) |

Varies; 0% promotional offers available |

Typically 18-29% |

Often 0% for short-term plans, but can be high |

Typically 6-36% |

|

Repayment |

Fixed monthly installments |

Minimum monthly payment on a revolving balance |

Fixed installments (e.g., 4 payments in 6 weeks) |

Fixed monthly installments |

|

Approval Speed |

Very fast (minutes) |

Fast (minutes to days) |

Very fast (seconds) |

Slower (days to weeks) |

Is Cherry Financing the Right Choice for You?

Deciding whether cherry financing is a good fit depends entirely on your personal and financial circumstances. It can be an excellent tool if you need to make a necessary purchase—like essential dental work or a critical home repair—but don’t have the cash on hand to pay for it all at once. The predictable monthly payments can make a large expense feel much more manageable. The quick application and soft credit check also make it an accessible option to explore without commitment or penalty to your credit score.

However, it’s not the right solution for everyone or every purchase. If you have a history of struggling to make payments on time, taking on any new debt could add financial stress. It’s also wise to consider if you can get a better interest rate elsewhere, perhaps through a promotional offer on a credit card you already own or a low-interest personal loan from your credit union. Before committing, ask yourself: Is this purchase a need or a want? Can I comfortably afford the monthly payments for the entire term? Answering these questions honestly will help you determine if using cherry financing aligns with your financial goals.

How to Maximize Your Approval Odds

While approval for cherry financing is designed to be accessible, there are steps you can take to increase your chances of getting a “yes.” First and foremost, ensure all the information you provide on your application is accurate and complete. Simple typos in your name, address, or social security number can lead to an automatic denial. Double-check everything before you hit submit. A stable income and employment history also play a significant role. Lenders want to see that you have a reliable source of funds to make your monthly payments.

Having a fair to good credit score will also improve your approval odds and help you qualify for lower interest rates. While cherry financing may approve applicants with less-than-perfect credit, a higher score always helps. You can work on improving your score by paying all your bills on time, keeping your credit card balances low, and avoiding opening too many new credit accounts at once. Applying for a reasonable amount that aligns with your income can also make a difference. Requesting a smaller financing amount may increase your likelihood of approval compared to asking for the maximum possible limit.

What Happens After You’re Approved?

Once you are approved for cherry financing and select your payment plan, the process is seamless. Cherry pays the merchant directly for the full cost of your service or product, so you don’t have to worry about any transactions with the business itself. Your responsibility is then to make your monthly payments directly to Cherry. You will receive information on how to set up your account on the cherry financing online portal or mobile app. Through this portal, you can manage your account, view your balance, see your payment schedule, and set up automatic payments.

Setting up autopay is highly recommended. It ensures your payments are made on time every month, which helps you avoid late fees and protects your credit score. Your first payment is typically due about 30 days after your loan is finalized. From there, you will continue to make your fixed monthly payments until the balance is paid in full. If you have a 0% promotional APR, be sure to pay off the entire amount before the promotional period ends to avoid being charged deferred interest. Managing your plan responsibly is key to having a positive experience with cherry financing.

Conclusion

Cherry financing offers a valuable and convenient way to pay for important purchases over time. With its fast application, use of a soft credit check for pre-qualification, and flexible payment plans, it stands out as a modern solution for managing expenses in sectors like healthcare, wellness, and home improvement. By providing a clear and simple path to financing, it empowers you to access necessary services without the stress of a large upfront cost. However, like any financial product, it’s important to use it wisely. Always review the terms, understand the APR, and ensure the monthly payments fit comfortably within your budget. When used responsibly, cherry financing can be a powerful tool for achieving your health and home goals.

Frequently Asked Questions (FAQ)

1. Does applying for cherry financing hurt my credit score?

No, the initial application for cherry financing uses a soft credit check, which does not affect your credit score. A hard credit inquiry may be performed if you accept and finalize a loan offer.

2. What kind of interest rates does cherry financing offer?

APRs vary based on your credit profile and the chosen plan. Rates can be as low as 0% for promotional offers but can be higher for other plans. Your specific rate will be shown to you before you commit.

3. Can I pay off my cherry financing plan early?

Yes, you can pay off your plan early without any prepayment penalties. Paying it off early can save you money on interest.

4. What happens if I miss a payment?

If you miss a payment, you may be charged a late fee. Missing payments can also be reported to credit bureaus, which could negatively impact your credit score. It’s best to set up automatic payments to avoid this.

5. How quickly do I get a decision?

The application process is very fast. Most applicants receive a decision within seconds to a few minutes after submitting their information.