Now Reading: Stock Market During Election Years: What Investors Should Know

-

01

Stock Market During Election Years: What Investors Should Know

Stock Market During Election Years: What Investors Should Know

Elections can feel like a whirlwind of news, debates, and uncertainty. It’s natural to wonder how all this political activity impacts your finances, especially your investments. Many people ask, “What happens to the stock market during election years?” It’s a great question, and understanding the historical patterns can help you feel more confident as an investor, no matter who is running for office.

The good news is that election years are not something to fear. While politics can create short-term bumps in the road, the market has a long history of moving upward over time, regardless of which party is in power. In this article, we’ll break down what typically happens to the stock market during election years, explore common investor anxieties, and provide strategies to help you navigate this period with a steady hand. We will look at historical data, sector performance, and what you can do to prepare your portfolio.

Key Takeaways

- Historically, the stock market has performed well during election years, often showing positive returns.

- Volatility can increase around election time due to uncertainty, but it’s usually short-lived.

- Trying to time the market based on election outcomes is a risky strategy that rarely pays off.

- Focusing on long-term investment goals and maintaining a diversified portfolio is the most effective approach for navigating the stock market during election years.

Understanding the Election Year Cycle and the Market

When we talk about the stock market during election years, it’s helpful to look at the “presidential election cycle.” This is a four-year pattern that some analysts use to track market behavior. While it’s not a perfect predictor, it gives us a framework for understanding potential trends.

The cycle suggests that the market often performs best in the third year of a president’s term, as the administration may push for policies to boost the economy ahead of the election. The fourth year, the election year itself, also tends to be positive. Why? The incumbent party wants to keep voters happy, and a strong economy and stock market can certainly help. They might avoid making unpopular economic decisions that could rock the boat. This creates a more stable environment, which investors generally like. Of course, every election is different, and global events can always change the picture. But looking back at decades of data shows a surprisingly consistent trend of positive returns in election years.

Historical Performance of the Stock Market During Election Years

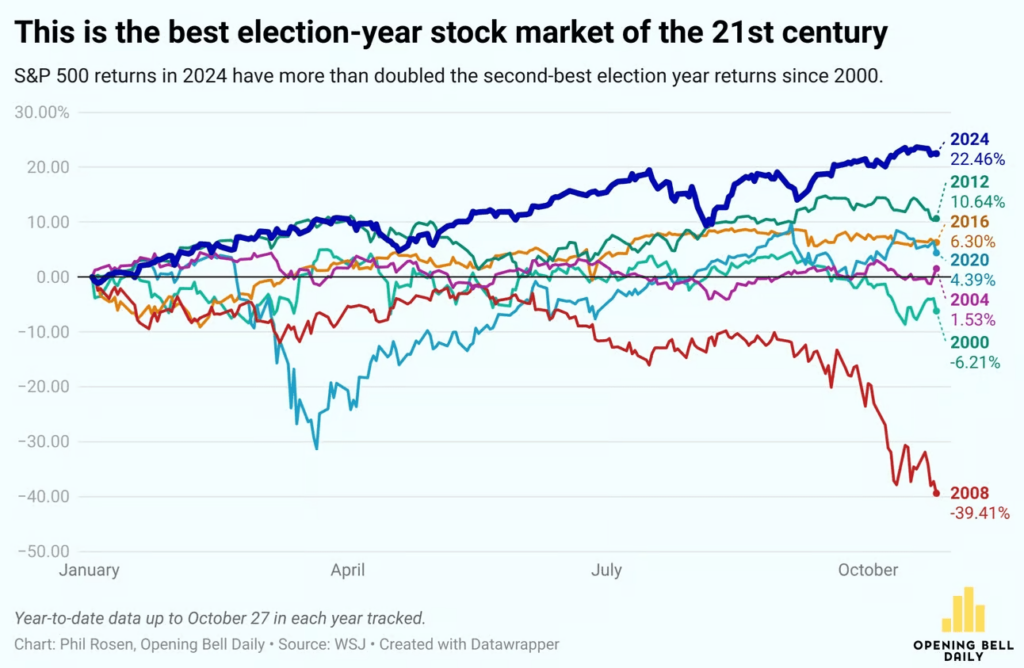

So, what does the data actually say? Let’s look at the numbers. Over the past several decades, the S&P 500—a key benchmark for the U.S. stock market—has shown a clear positive trend.

Historically, the stock market during election years has finished in positive territory a majority of the time. Since 1928, U.S. presidential election years have seen the S&P 500 rise about 75% of the time. The average return in these years has been solid, often close to the long-term market average. While there are exceptions, the overall pattern is one of resilience.

For example, even in years with contentious elections and surprising outcomes, the market has often recovered from any initial shock and continued its upward trajectory. This tells us that while politics creates headlines, the underlying drivers of the stock market—like corporate earnings, innovation, and economic growth—are what truly matter in the long run. Investors who stay calm and stick to their plans often find that election-year worries are more noise than substance.

Pre-Election Jitters vs. Post-Election Rallies

It’s common to see some choppiness in the months leading up to an election. This “pre-election jitter” phase happens because markets don’t like uncertainty. Investors might hesitate to make big moves when they don’t know who will win or what policies will be implemented. This can lead to increased volatility, with the market swinging up and down more than usual.

However, once the election is over and the winner is clear, a sense of relief often sweeps through the market. This frequently leads to a “post-election rally.” With the uncertainty gone, investors can finally assess the new political landscape and position their portfolios accordingly. This rally tends to happen regardless of which party wins. The key factor is the removal of uncertainty. This pattern highlights why it’s so important not to make rash decisions based on pre-election anxiety. The market has a way of sorting itself out once the dust settles.

Does the Winning Party Matter for the Stock Market?

One of the biggest questions investors have is whether a Democratic or Republican victory is “better” for the stock market. People often assume that one party’s policies will be more business-friendly than the other’s. However, the historical data tells a more nuanced story.

When you look at market performance under different presidents, you’ll find that the stock market has gone up under both Democratic and Republican administrations. In fact, some of the best market runs have occurred under presidents from both parties. This suggests that the occupant of the White House is not the single most important factor for your investment returns.

Broader economic forces, such as interest rates, inflation, global trade, and technological advancements, have a much larger and more lasting impact on corporate profits and stock prices. While presidential policies can influence certain sectors, the overall economy is a massive ship that is not easily turned by one person. For more insights on global economic trends, you can explore resources like those found at https://forbesplanet.co.uk/.

Market Performance Under Democratic vs. Republican Presidents

Let’s dig into the numbers a bit more. Analysts have crunched the data for decades, comparing market returns under different administrations. Surprisingly to some, the stock market has, on average, performed slightly better under Democratic presidents than Republican ones since World War II.

However, it’s crucial not to draw the wrong conclusion from this. Correlation does not equal causation. A president often inherits an economy that was shaped by their predecessor and by global events beyond their control. For example, a president who takes office at the bottom of a recession is more likely to preside over a market recovery than one who takes office at a market peak. Therefore, attributing all market gains or losses to the current president is an oversimplification. The real takeaway is that the stock market during election years and beyond can thrive no matter who is in charge.

|

Presidential Term |

Party |

S&P 500 Annualized Return |

|---|---|---|

|

1945-1953 (Truman) |

Dem |

15.3% |

|

1953-1961 (Eisenhower) |

Rep |

14.7% |

|

1961-1963 (Kennedy) |

Dem |

10.4% |

|

1963-1969 (Johnson) |

Dem |

13.0% |

|

1969-1974 (Nixon) |

Rep |

-4.9% |

|

1974-1977 (Ford) |

Rep |

18.6% |

|

1977-1981 (Carter) |

Dem |

10.9% |

|

1981-1989 (Reagan) |

Rep |

15.3% |

|

1989-1993 (Bush Sr.) |

Rep |

14.8% |

|

1993-2001 (Clinton) |

Dem |

17.2% |

|

2001-2009 (Bush Jr.) |

Rep |

-4.0% |

|

2009-2017 (Obama) |

Dem |

13.8% |

|

2017-2021 (Trump) |

Rep |

14.0% |

|

2021-Present (Biden) |

Dem |

Ongoing |

Note: Returns are approximate and for illustrative purposes. Actual returns vary based on calculation methods.

Sector Performance: Which Industries Do Well?

While the overall market tends to be resilient, certain sectors can be more sensitive to election outcomes. This is because different parties have different priorities that can translate into policies affecting specific industries.

For instance, a party focused on environmental issues might push for regulations and investments that benefit the renewable energy sector. This could include solar, wind, and electric vehicle companies. On the other hand, a party prioritizing deregulation might create a more favorable environment for the financial and traditional energy sectors, like oil and gas.

Here are a few sectors to watch:

- Healthcare: This sector is almost always in the political spotlight. Debates over drug pricing, insurance coverage, and public health initiatives mean that healthcare stocks can be volatile around elections.

- Defense: A change in administration can lead to shifts in foreign policy and military spending, directly impacting defense contractors.

- Infrastructure: Both parties often talk about rebuilding America’s roads, bridges, and grids. Companies in construction, materials, and engineering could benefit if a major infrastructure bill is passed.

- Technology: While often seen as less politically sensitive, big tech companies have faced increased scrutiny over antitrust issues and data privacy from both sides of the aisle.

Understanding these potential impacts can be interesting, but it’s risky to overhaul your portfolio based on them. It’s often better to maintain broad diversification across many sectors.

Common Investor Mistakes During Election Years

The emotional nature of politics can lead investors to make predictable—and often costly—mistakes. Navigating the stock market during election years successfully means avoiding these common traps.

1. Panic Selling Based on Fear

The biggest mistake is letting fear drive your decisions. Media headlines are designed to grab your attention, and during an election, the tone can be especially alarming. It’s easy to get caught up in the worry and think, “If my candidate loses, the economy will crash!” This can lead to panic selling, where you sell your investments at a low point out of fear. But as history shows, the market tends to recover. Selling in a panic just locks in your losses.

2. Trying to Time the Market

Another major error is trying to time the market. This involves selling before the election with the plan to buy back in after the uncertainty has passed. The problem? It’s nearly impossible to do successfully. You have to be right twice: once when you sell and again when you buy back in. Many who sell miss out on the post-election rally and end up buying back at a higher price than where they sold. A far better strategy is to stay invested and ride out the short-term volatility.

3. Making Major Portfolio Changes

Drastically changing your investment strategy based on who you think will win is a form of market timing. You might shift all your money into sectors you believe will benefit from a certain outcome. But what if you’re wrong about the winner? Or what if you’re wrong about which policies will actually get passed? It’s a gamble that often doesn’t pay off. A well-diversified portfolio is designed to perform reasonably well under various economic conditions, removing the need to make big bets on political outcomes.

Strategies for a Successful Election Year

So, how should you approach investing when the political landscape is front and center? The best strategies for the stock market during election years are the same ones that work in any other year.

Focus on Your Long-Term Goals

Remember why you are investing in the first place. Are you saving for retirement, a child’s education, or a down payment on a house? These goals are years or even decades away. A single election is just a small blip on that long timeline. Keep your focus on your personal financial plan, not on the political drama of the day. This long-term perspective is your best defense against short-term market noise.

Maintain a Diversified Portfolio

Diversification is the golden rule of investing. It means spreading your money across different types of assets (like stocks and bonds) and different sectors of the economy. A diversified portfolio helps smooth out your returns. If one sector is struggling because of a new policy, another sector might be thriving. This balance protects you from having all your eggs in one basket and is essential for navigating the uncertainty of the stock market during election years.

Continue to Invest Regularly

Don’t let an election year pause your investment plan. Continuing to invest a set amount of money at regular intervals—a strategy known as dollar-cost averaging—is incredibly powerful. When you invest regularly, you buy more shares when prices are low and fewer shares when prices are high. This removes emotion from the equation and ensures you are consistently building wealth over time, regardless of what the market is doing in any given month.

Conclusion

The intersection of politics and finance can seem complicated, but the key takeaway for investors is refreshingly simple: stay calm and stick to your plan. The historical evidence overwhelmingly shows that the stock market during election years is not something to be feared. While short-term volatility is possible, the market has a strong track record of positive performance and resilience. The winning party has far less impact on long-term returns than fundamental economic drivers.

By avoiding common mistakes like panic selling and market timing, and instead focusing on your long-term goals, maintaining a diversified portfolio, and investing consistently, you can navigate any election year with confidence. Remember that successful investing is a marathon, not a sprint, and political cycles are just part of the course.

Frequently Asked Questions (FAQ)

Should I sell my stocks before an election?

No, trying to time the market by selling before an election is generally a bad idea. History shows that post-election rallies are common, and you risk missing out on significant gains. It’s better to stay invested according to your long-term plan.

Does the stock market go up more under a certain political party?

While some data shows slightly higher average returns under Democratic presidents, the difference is not significant enough to base an investment strategy on. The market has performed well under both parties, and economic factors beyond the president’s control are more influential.

How volatile is the stock market during election years?

Volatility can increase in the months leading up to an election due to uncertainty. However, this volatility is typically short-lived and tends to subside once the election outcome is clear.

Which sectors are most affected by elections?

Sectors like healthcare, energy, defense, and infrastructure can be sensitive to election outcomes because they are often the subject of policy debates. However, trying to pick winning sectors is risky, and a diversified approach is safer.